Statista’s Digital Advertising Report 2021 is a comprehensive overview of the state of the Digital Advertising market as it is today as well as a prognosis with detailed information on five different market segments in the advertising areas of Search, Social Media, Banner, Video, and Classifieds.

Digital Advertising Outlook Report shows selected key market drivers, market shares, average ad spending per internet user, programmatic shares, industry splits, deep dive topics as well as some insights from Statista’s Global Consumer Survey.

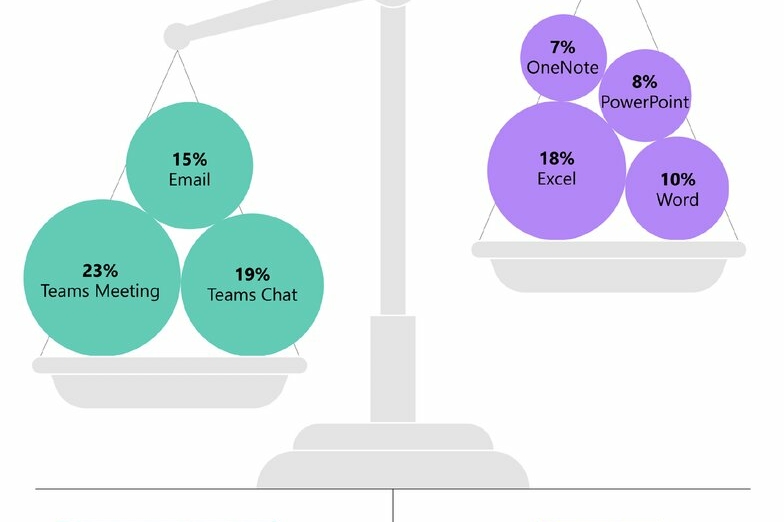

The Digital Advertising market comprises 4 media segments

- Search Advertising

- Banner Advertising

- Video Advertising

- Classified

The First Digital Advert

By paying US$30,000 to WIRED’s predecessor HotWired in 1994 for placing the first banner ad on its website, AT&T and the first commercial online magazine laid the foundation for the Digital Advertising market.

With a click-through-rate (CTR) of 44% at that time, the first banner ad achieved a success that present advertisers can only dream of, as they are struggling along modern advertising methods and formats like programmatic or native advertising.

What is Digital Advertising?

Digital Advertising uses the internet to deliver marketing messages in various formats to internet users. This includes advertisements in results pages of search engines (Search Advertising); advertising in social media networks in the form of, for instance, sponsored posts (Social Media Advertising); advertisement banners like e.g. so-called skyscrapers (Banner Advertising); advertisements within video players (Video Advertising); and paid digital classifieds (Classifieds).

The Top Digital Advertising Markets

Comparing the three major Digital Advertising markets – the U.S., China, and Europe – the U.S. was the biggest market in 2021 with US$190.4 billion. Thus, the U.S. accounts for more than one third of the world’s Digital Advertising spending, leaving China und especially Europe far behind with shares of respectively only 22.5% and 18.9%

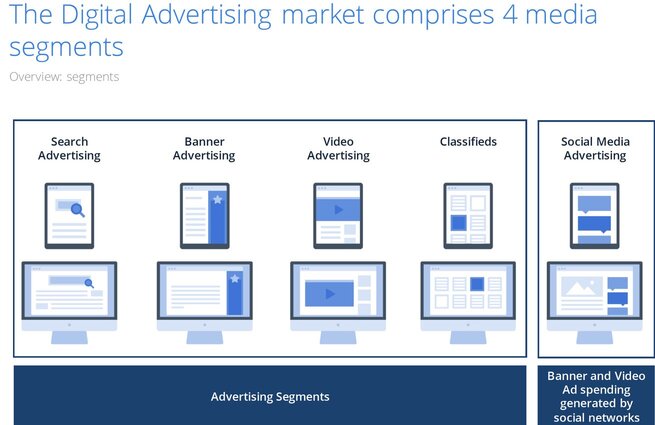

▪ Search Advertising

− Largest Digital Advertising segment in 2021, with revenues of US$182.9 billion worldwide

− Accounting for 39.3% of the worldwide Digital Advertising market

▪ Banner Advertising

− Second largest Digital Advertising segment in 2021, revenues in Banner Advertising are mainly fueled by mobile spending (more than 67.3% in 2021)

▪ Video Advertising

− Fastest-growing segment with a CAGR1 of 11.9% by 2026

▪ Classifieds

− Smallest segment with a worldwide share of only 4.3%

Social Media Advertising

− Third largest Digital Advertising segment in 2021, with revenues of US$153.7 billion worldwide

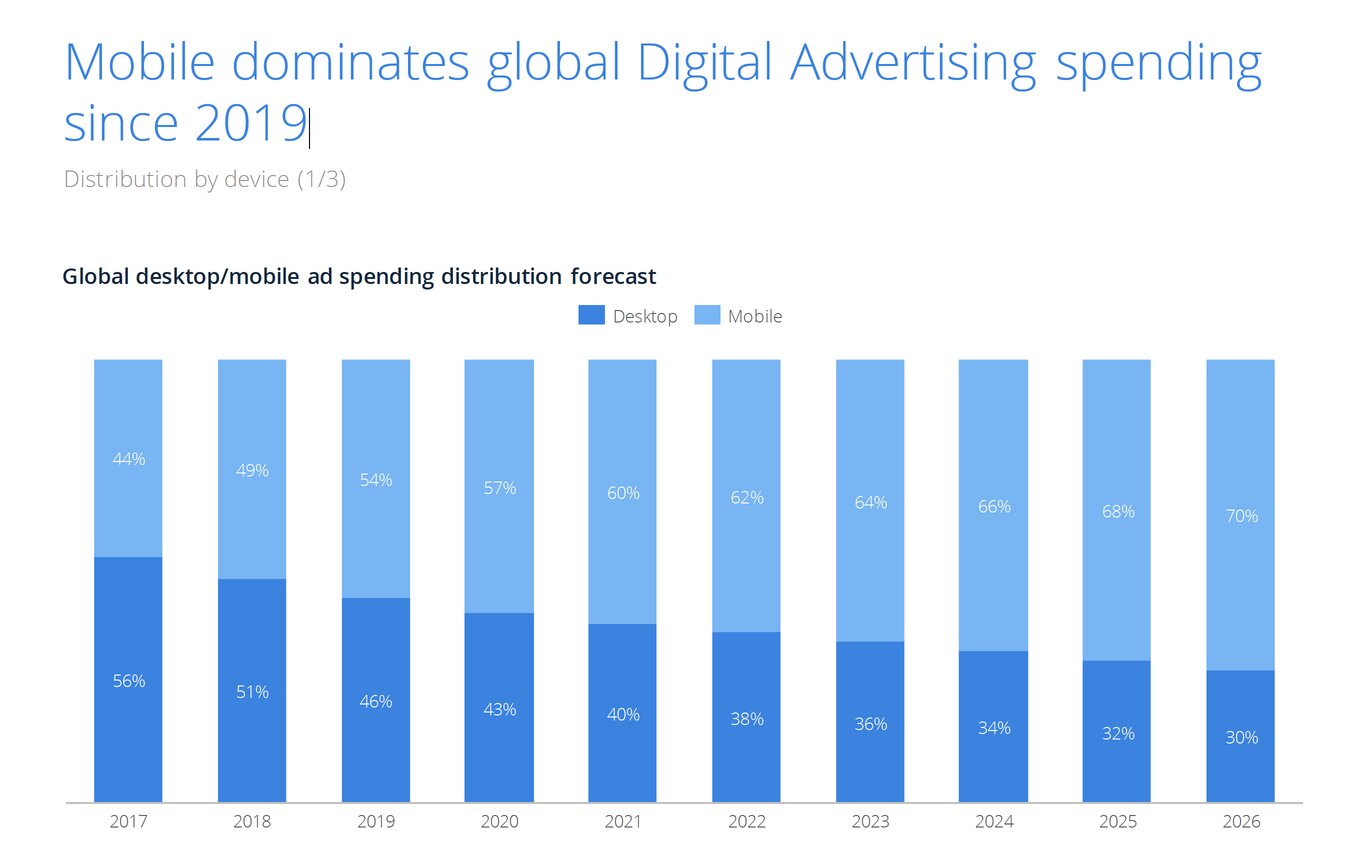

The Future is Mobile

While the share of global mobile revenues was 59.5% in 2021, the expected share in 2026 will be 70.0%. The most affected segment will be Video Advertising. Here, we expect a shift in shares of around 18.3% leading to a mobile share of 84.1% in 2026.

Ad blocking software is a serious threat for advertising revenues, calling advertisers for action

Ad blocking or ad filtering describes the removal of advertising content on websites with the help of additional software or browser extensions available for desktop and mobile. For many users, enjoying a less disturbed and distracted web experience is the main reason for using such software.

Ad blocking software is able to block banners, pop-ups, and video ads – even on social media services, in video players or in mobile apps. Unobtrusive ads are not necessarily blocked although “unobtrusive” is broadly defined. However, the blocking of any kind of advertisement is usually always possible.

What is Native Advertising?

Native advertising means the seamless matching of advertisements to the form and function of the environment (e.g. news websites, video platforms) in which they appear. They can manifest as articles or videos. Usually, these native advertisements have a so-called advertorial character, meaning that they resemble an editorial-shaped design and look. Companies like Outbrain and Taboola have specialized in this field of advertising

Native advertising can be seen as a successor to product placement, as the advertised product is not only placed within the content it appears in but is even merged with it.

What is Programmatic Advertising?

Programmatic advertising describes the software-based method of buying, displaying, and optimizing of advertising space driven by audience data in order to better target certain potential customers. The recipient of the ad is known before the ad is actually sold. Thus, the ad can be even more personalized. This process takes place within a split second.

The method is also paving the way for a variety of smart and innovative ad formats like advertising in audio streams, podcasts, connected TVs and cars, or Digital Out Of Home1 solutions, breaking down the barrier between digital and analogue.

Programmatic advertising has the potential to revolutionize advertising based on user targeting

Search Advertising – Search Advertising reaches relevant target groups in a very simple and precise way

Customer Benefit

With keywords as an underlying basis, Search Advertising enables marketers to reach a relevant target group in a very simple and precise way. These keywords can be complemented with a range of options like location-based factors, website type, audience type or remarketing based on user behaviour.

In comparison to other advertising formats, search advertisements are less obtrusive as they do not necessarily appear as foreign objects to recipients but often as useful links leading to a website a user was looking for anyways. Also, its unobtrusiveness makes search advertisements less of a target for ad-blocking software. Another benefit for advertisers arises from the low effort it needs to adjust those ads to mobile use as present software can accomplish this automatically.

Market size and future development

The global Search Advertising market volume was about US$182.9 billion in 2021 with share of 39.3% of the total Digital Advertising market. With this share, Search Advertising is by far the biggest segment in the Digital Advertising market. by 2026, Search Advertising will remain the biggest segment within Digital Advertising with revenues of US$272.5 billion.

By 2026, Search Advertising will remain the biggest segment within Digital Advertising with revenues of US$272.5 billion.

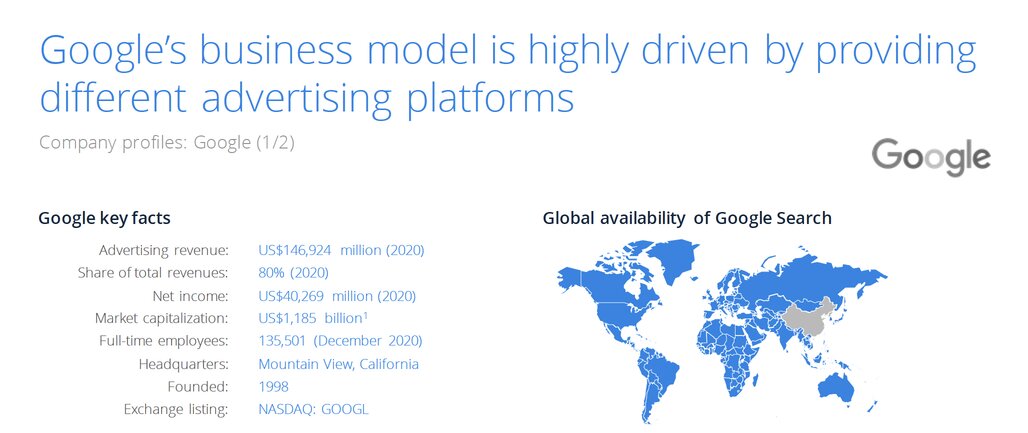

Google’s business model is highly driven by providing different advertising platforms

Besides the popular search engine, Google offers many other internet related services such as Maps, Drive, Mail, Calendar, Docs, Photos, and YouTube. Furthermore, Google dominates the smartphone market software-wise with its own operating system Android and develops own hardware such as the smartphone series Pixel and a variety of smart home products powered by Google’s own voice assistant.

By launching its online advertising platform Google Ads (previously Google AdWords) in 2000, the company laid the cornerstone for being one of the world’s most relevant digital ad networks and providing the dominant product in the field of search advertising. Today, services like Google Ads, Google Marketing Platform or YouTube Ads allow marketers to take advantage of different channels and formats such as search results, banners, and videos for advertising their products.

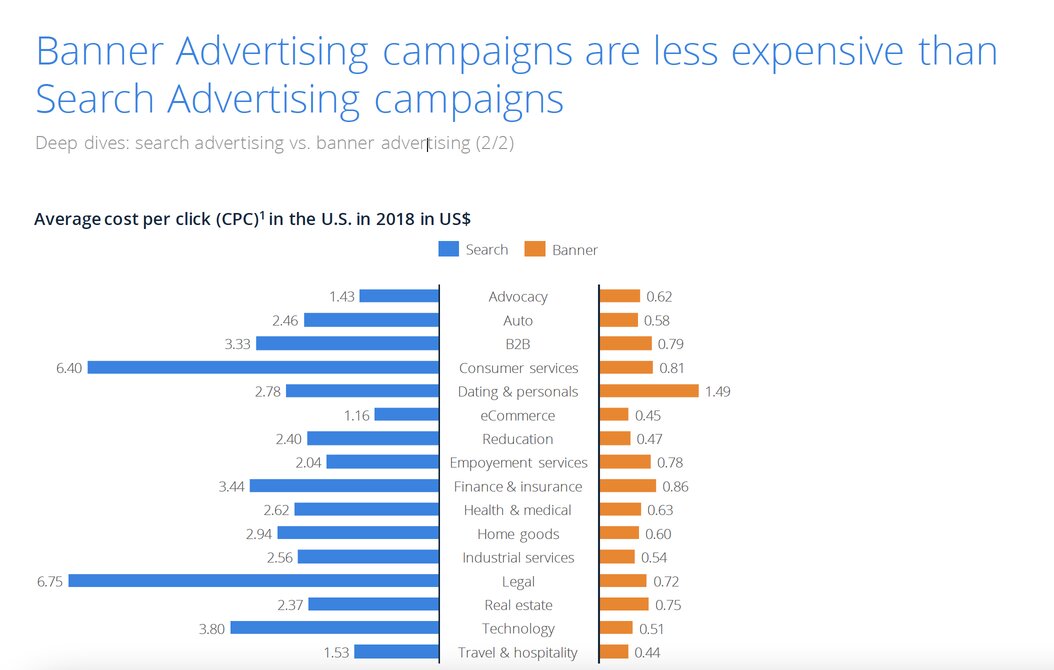

Banner Advertising

Nowadays, Banner Advertising offers several different approaches for buying advertisement spaces. Advertisers can choose between private marketplaces, where they can select and buy ads from premium publishers or totally automated buying processes.

Banner Advertising is one of the most common forms of Digital Advertising. It allows a huge range of different formats from small text-based ads to complex animated banners. Banners come in various shapes, sizes, and formats and can be displayed on all screen sizes and in a broad range of contexts, from websites accessed via desktop PCs over mobile-enabled websites to smartphone apps.

Typical formats of banner advertisements are skyscrapers, wallpapers, interstitials or pop-ups, which usually link to a landing-page hosted by the respective advertiser. In addition to these static banners, so-called rich media banners allow playing sounds, animations or videos. Videos that are played instead of a static banner outside a video player are considered as rich media. The decisive criterion is not the moving image itself but whether it is in-page or in-stream.

The global Banner Advertising market size was about US$170.2 billion in 2021 which equals a share of 36.6% of the Digital Advertising market. In other words, Banner Advertising is the second biggest market in Digital Advertising behind Search Advertising.

Video Advertising

After the rise of web 2.0 and its incoming waves of social media networks and other interactive websites and platforms, user-generated content has gone through a steady professionalization of video content. On the one hand, that allows content creators and license holders to offer premium video content free of charge as content can refinance itself through advertising.

Market size and future development

The global Video Advertising market size was about US$92.3 billion in 2021 and accounted for 19.8% of the Digital Advertising market. With a CAGR1 of 11.9%, the segment will grow to US$162.2 billion by 2026.

Connectivity will be much faster than today’s technologies, allowing complex video ads to be displayed

Online Classified

The Classifieds segment includes fees paid by advertisers in order to display a classified ad or listing around a specific vertical. Distinctions are made between General, Real Estate, Jobs, and Motor as well as Desktop and Mobile. Besides relatively low prices, classifieds have the advantage to reach very specific target groups without excessive scattering losses which we can, for instance, observe in the field of Banner Advertising.

In contrast to other Digital Advertising formats, Classifieds have a pull characteristic. The audience is usually looking for the product (category) the classified is already advertising for. This makes reaching the desired target group much easier and lowers the financial effort.

Market size and future development

in 2021, the global Classifieds market size amounted to US$20.1 billion and covered 4.3% of the total Digital Advertising market. Considering the segment’s CAGR1 of only 3.5% by 2026, the Classifieds market will remain the smallest one with revenues of US$23.9 billion in 2026.

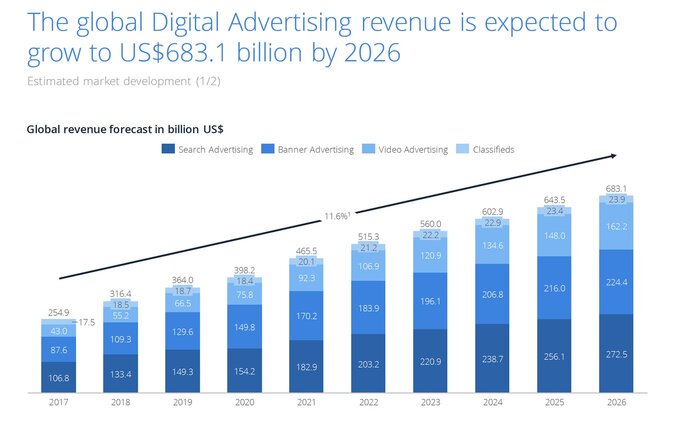

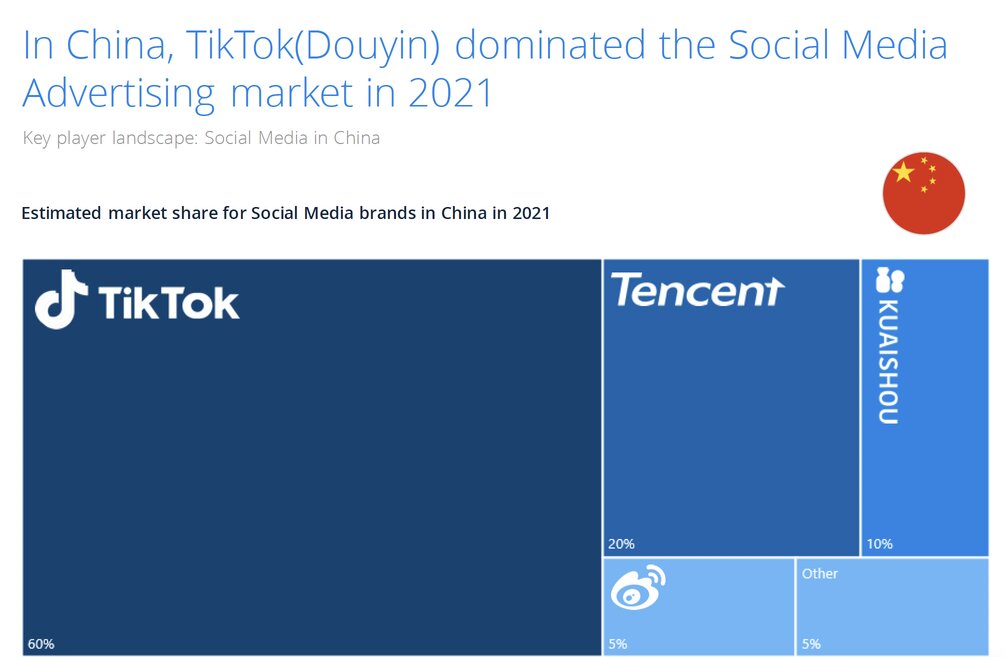

Social Media Advertising

The Social Media Advertising segment includes all ad spending generated by social networks or business networks. Ads can appear as sponsored posts within organic content or besides the newsfeed.

The key elements of social media besides its networking aspects are communication and interaction with other participants. Social media networks usually contain at least one of the following opportunities for action: The contribution of user-generated content, comments on postings, sharing the contribution of others or direct communication with other members. The interaction causes high involvement and personal recommendations gain immediate social proof.

Market size and future development

The global Social Media Advertising market size was about US$153.7 billion in 2021 and accounted for 33.0% of the total Digital Advertising market with a CAGR1 of impressive 10.4% by 2026.

The U.S. market is by far the leading market in Social Media Advertising and generated revenues of about US$56.7 billion in 2021. That is a 29.8% share of the total U.S. Digital Advertising market.

In China, Social Media Advertising is the largest segment of the Digital Advertising revenue. Expressed in absolute figures, Social Media Advertising generated US$45.1 billion in 2021 and accounted 43.7% of Digital Advertising in China.

From currently 3.8 billion social media users in 2021, we are expecting a growth up to 4.6 billion users by 2026.

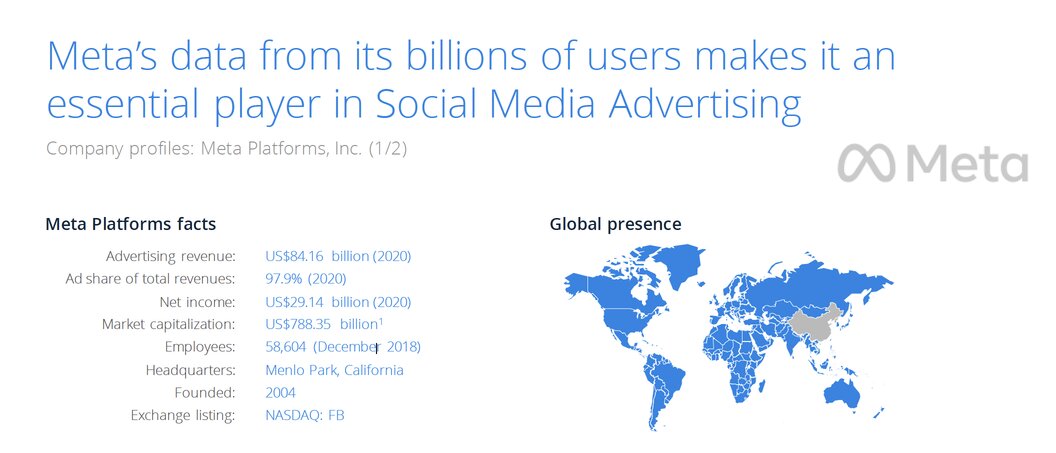

With its impressive user base Meta is capable of gathering huge amounts of user data such as age, location, social relations, and interests. Combined with its advertising platform Facebook Ads, the company became one of the most attractive advertising services in recent years. This development will probably strengthen with a potential opening of WhatsApp for advertisements in the near future.

Advertising strategy

Facebook succeeded in monetizing its core business with advertising. However, the implementation of advertising on mobile has still to be seen as a breakthrough in the digital advertising market. We can still see high growth rates although Facebook’s mobile messaging services (with up to 1.5 billion users) have no advertising on it yet. These services and the constant development of existing formats promise a huge potential for the future growth of Facebook.

Need help with developing a digital strategy for your business? Get in touch.